Given the looming threat of rising non-performing loans (NPLs), it is crucial that debt collection leaders adopt a smart approach when it comes to recouping what they are owed. However, as things stand, they are not doing this. What are the current hurdles preventing collections teams from solving debts efficiently and effectively?

- Inadequate reporting, fuelled by weak and often inaccurate data, harms strategic collections planning. Money is wasted following inefficient, overly complex, and cumbersome processes.

- Disparate existing tools render debt collection teams unable to create, analyse, and optimise holistic, omnichannel collections strategies. This makes it impossible to provide a truly customer-centric experience.

- Case management is stymied when collections professionals have to jump between several decentralised tools, manually mining and updating customer data as they go.

The answer?

A single, AI-based solution that integrates all existing tools under one roof. This will make it easier for collections teams to access critical metrics, improve their strategies on an ongoing basis, reach large volumes of past-due customers, enhance their customer experience, and transform their retention rates.

Overcoming Reporting Roadblocks

Reporting is the lynchpin behind debt collection success. Effective reporting (based on detailed data analysis) reveals individual past-due customers in granular detail: their demographics, preferences, habits, and dislikes. Collections strategists can use this information to work backwards, identifying what customers respond well to before serving them similar approaches in the future.

Of course, you already know all this. You might, however, be limited by the tools currently at your disposal. You can dive into a customer’s financial history on one platform, take a glimpse into their messaging preferences on a different system, and analyse email and SMS messaging success on another tool.

But you’re unable to link this all together into one easy-to-view case management portal.

With receeve’s new Case Management feature, strategists can glean must-know insights at all times by consulting a single source of truth. You can easily craft tailored strategies that take into account each individual’s context and preferences, thereby increasing the chance they will be successful.

Digging into the details

Unfortunately, not all strategies immediately work as well as hoped.

With AI-powered debt collection management software, collections leaders can delve into why this is. The right software allows them to analyse how successful each of their strategies have been—both on an overall, macro level, as well as on an individual basis.

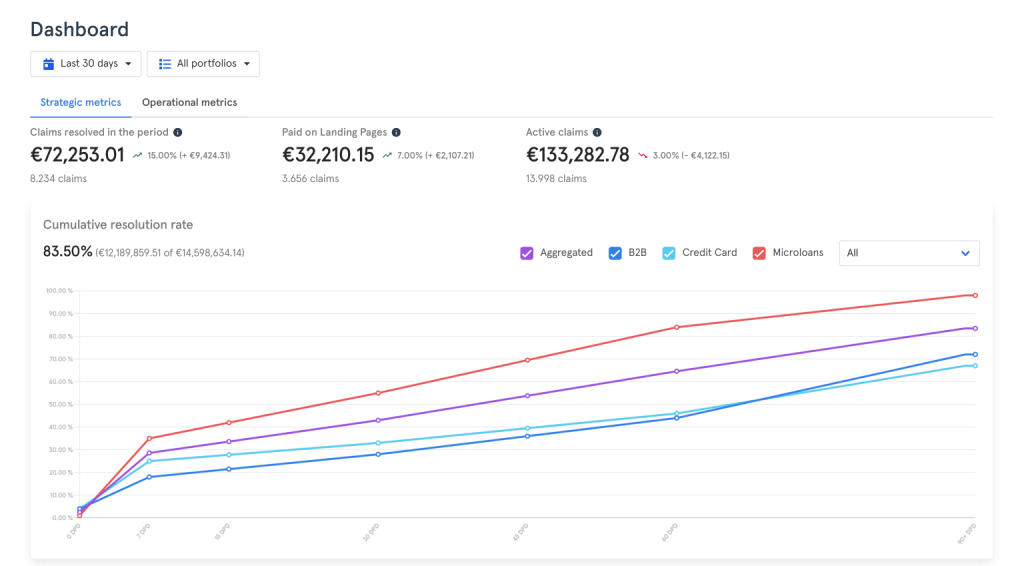

For example, the receeve Dashboard displays overall collections success according to both strategic and operational metrics. It reveals the value of claims received within a certain period, the value of all active claims, and allows agents to segment according to the nature of these claims: business loans, credit cards, B2B, etc.

If you want to get more granular details, the receeve Insights feature allows a Head of Collections to analyse each landing page that is currently running. It reveals key data like the number of overall visitors, percentage of visitors that attempted payment, percentage whose payment successfully went through, and specific click-rates regarding each aspect of your landing page: ID verification, choosing a payments provider, those that click ‘I need help’, and more.

The feature also allows you to take a step back and assess your outreach success. Analyse a wealth of typical digital communications KPIs to dig into precisely why one email is more/less effective than another alternative. It also allows you to hone in on the exact elements that are over/underperforming—providing crucial insights that will help improve your outreach approach in the future.

From Reporting to Results

Accurate data is just the first step. From there, it is up to agents (or data analysts) to understand what the data is telling them. They then need to feed these insights back into their approach, creating a customer experience (CX) that appeals to each individual past-due customer or target segment.

This process is a breeze with AI functionality. Leveraging AI—for instance, by using the receeve AI Optimisation tool—you can easily A/B test different strategies at scale.

Imagine you have 5 or 6 different email templates, all featuring different design and content. When designing your collections workflow within receeve, you are unsure which template will work best—so you decide to try them all with the help of personalisation tokens. These tokens, attached to your customer database, personalise the content that each customer is served according to their specific CRM property values (i.e. job role, company, age, segment, etc.).

To do this, simply add them in as different channels. The tool will then take these different templates and send each of them out to a portion of your target audience. The results of these emails are immediately relayed in an easy-to-view colour-coded graph—though you can also view the raw data itself.

Over time, the AI optimisation tool will automatically begin sending out a higher volume of emails from successful templates and will reduce the number of messages sent out using the so-far unsuccessful templates.

This equals increased collections success. By implementing receeve’s collections management software, Ferratum reinvented their CX and transformed their bottom line, resulting in a:

- 15.1% increased in cash collection;

- 68% decrease in outbound calls;

- 9.1% increase in 7 days past due (DPD) customers’ payback;

- 3X increase in instalment plans.

Simplicity is key

You might be thinking: “Sure, that all sounds great—but I’m too busy to waste my time painstakingly crafting new landing pages, emails, and so on.” These days, however, this should not be a concern.

Leverage the power of no-code, ‘what you see is what you get’ (WYSIWYG) drag-and-drop Content Builders to craft an entirely new automated customer journey in a matter of minutes.

Play around with different copy, fonts, colour schemes, and pre-built templates. Want to add a new button, a QR code, or a fancy image? Just drag and drop. Want to create a self-service landing page from scratch or offer customers a series of instalment plans to choose from? Just drag and drop. This is a far cry from having to consult with IT, ask them to dive into the backend, and finally see the finished result.

Embrace case management

Case management lifts the lid on individual past-due customers. With a case management portal like receeve’s, agents can access all need-to-know information in one single place. Agents can identify each individual’s personal details, their financial history, their outstanding debts, perceived level of risk, current payment plans, relevant legal documentation, and more.

You can also instantly see whenever they open a message or click through on a payment link. With one click, you can start a call with this particular past-due customer—meaning no more digging around trying to find their contact details. You can even integrate contact data verification software into receeve, guaranteeing that you always have the right phone number or email address for any given past-due customer.

Embrace a smart approach to collections

The key to achieving debt collection success lies in working smarter, not harder. Agents don’t need to adapt their ways of working around the tools they use—it should be the other way around. Fortunately, this is as simple as investing in a future-proofed collections management software.

Wave goodbye to flitting between multiple disparate tools. Instead, unite your different tools and strategies under a single one-stop-shop. Gain complete visibility into your overall collections performance at all times. With case management capabilities, you can drill down into the nitty-gritty details regarding a particular strategy’s success or a specific individual’s behaviour.

Agents will become more productive—meaning you will increase your recovery rate and decrease your cost to collect.

Ready to get started? If so, book a demo today.

.jpg)

.jpg)